By understanding tips on how to calculate it, interpret its implications within trade context, and acknowledge the factors that influence it, individual buyers can transfer past superficial evaluation. A persistently high or rising ACP indicators that a company’s money is tied up in receivables, decreasing its liquidity. This can drive a company to borrow extra or delay payments to its own suppliers, creating a ripple impact on its financial well being. Strong cash move from operations, facilitated by a low ACP, is the lifeblood of a wholesome business. If your aim is to collect inside 30 days, then a median assortment period of 27.38 would sign efficiency.

What Is An Effective Average Assortment Interval Ratio?

The greatest way that a company can profit is by consistently calculating its common collection interval and using what is the average collection period it over time to seek for developments inside its own enterprise. The common assortment interval can also be used to check one firm with its rivals, either individually or grouped. Comparable firms should produce similar financial metrics, so the typical assortment period can be used as a benchmark against one other company’s performance. The common collection period is an indicator of the effectiveness of a firm’s AR administration practices and is a vital metric for companies that rely closely on receivables for his or her money flows. A long assortment period increases the danger of now not having sufficient cash accessible.

Cash Flow Statement: Breaking Down Its Importance And Evaluation In Finance

This improves working capital administration and reduces the risk of fee defaults. Companies monitoring ART ratios identify cost assortment trends and potential cash flow points earlier than they impact operations. A declining ratio indicators growing assortment delays, while an enhancing ratio signifies more effective credit management practices.

While usually lower is healthier, an exceptionally low Average Assortment Period may, in rare instances, indicate that a company’s credit policies are too strict. This may result in shedding potential gross sales to competitors who offer extra flexible credit terms, thereby limiting income development. To decide the Days Sales Excellent (DSO) ratio, a formulation often identified as Days Sales Outstanding (DSO) is used. This formula reflects the average number of days corporations need to gather outstanding payments from their clients. When assessing whether your average assortment interval is sweet or dangerous, it’s important you contemplate the variety of days outlined in your credit phrases. Whereas at first look a low average assortment period may point out larger efficiency, it may additionally indicate a too strict credit score coverage.

Average Collection Period: Calculator, Examples, Methods To Enhance

The Typical Assortment Period (ACP) for a agency measures the variety of days an organization takes to collect payments from credit score gross sales, with retail averaging 30 days and manufacturing extending to ninety days. According to the 2023 Credit Score Administration Association (CMA) examine, companies sustaining ACP under trade benchmarks reveal 25% higher cash flow management compared to their friends. Corporations compare their assortment intervals in opposition to business benchmarks to evaluate efficiency. For example, a retail firm amassing funds in 25 days versus the business commonplace of 30 days demonstrates superior assortment efficiency. This comparability helps businesses determine areas for enchancment in their credit score management processes. The Accounts Receivable Turnover ratio is calculated by dividing the total web credit score gross sales by the average accounts receivable.

Proven Strategies To Chase Excellent Invoices And Boost Cash Move

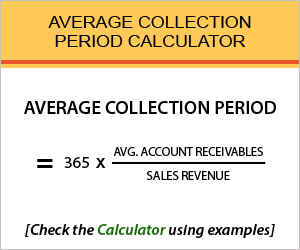

The average assortment period is an estimation of the common time interval wanted for a business to obtain fee for money owed to them. This is especially useful for firms who promote products or services through traces of credit score. The average collection interval can also be referred to as the times to collect accounts receivable and as days sales outstanding. The Accounts Receivable Turnover ratio supplies insights into an organization’s effectivity in accumulating money owed.

Your entire staff can access your customers’ entire fee history, providing you with a clear image of your assortment efforts. In the primary formula, we first need to discover out the accounts receivable turnover ratio. For the formulation above, average accounts receivable is calculated by taking the typical of the beginning and ending balances of a given interval. Extra sophisticated accounting reporting instruments may have the ability to automate a company’s average accounts receivable over a given interval by factoring in daily ending balances.

The shorter the gathering interval, the extra indicative it’s of the company’s assortment course of effectivity. Nevertheless, care should be taken to avoid extreme stress on prospects, which might negatively affect the connection with them. To tackle your common assortment period, you first need a reliable source of knowledge. When you log in to Versapay, you get a transparent dashboard of the present standing of all of your receivables.

Modern monetary systems observe cost patterns through artificial intelligence algorithms, identifying potential delays earlier than they impression working capital management and operational effectivity metrics. Corporations monitoring web accounts receivable tendencies identify fee sample adjustments via monthly comparative evaluation. These insights allow proactive credit policy changes, preventing cash move disruptions that have an effect on business operations. Organizations monitoring this metric implement automated collection methods, leading to 25% sooner fee assortment and improved working capital utilization for strategic investments.

- The average assortment interval is the period of time it takes a company to obtain payments on the cash that’s owed to them.

- A good Common Collection Interval Ratio ranges from days for B2B businesses and days for B2C companies, indicating environment friendly receivables management.

- A low common assortment period signifies that the group collects funds quicker.

- Every business proprietor should work to make sure customers are paying invoices in a timely method.

- According to the 2024 Credit Administration Affiliation (CMA) benchmark study, corporations sustaining an AR turnover ratio above eight.0 experience 30% fewer bad debt write-offs.

- On the opposite hand, overly strict policies may deter potential clients, so it’s a delicate steadiness.

When clients take longer to pay their bills, less cash is coming into the company. If we imagine a scenario where all customers delay their funds, the company wouldn’t be receiving any cash, though it may be generating vital gross sales on paper. This can create a money crunch, making it challenging for the company to satisfy its regular operational bills, including worker salaries, utility payments, and provider https://www.kelleysbookkeeping.com/ invoices.